An Invoice is a list of Goods supplied or Services provided along with the amount due for the payment. As a registered GST dealer, you are required to provide GST compliant invoices; it is sometimes also known as GST bills. Currently, Suppliers and Services providers generate invoices through various software, and the details of these invoices are manually uploaded to the GSTR-1 return. The invoice particulars are thereafter reflected in GSTR-2A of the recipients for viewing only.

A supplier in the state of Maharashtra can upload an invoice on the mahagst portal. There is a difference in the central government and the Maharashtra state portal. You can know all about mahagst by checking the mahagst portal. An invoice can be personalized with the company’s logo in some software. Some software providers give the option to personalize GST invoices. Software is required to create a GST compliant invoice because it can become complex to do it manually. The GST invoice format in excel is easier to create, and you can see the excel format further in this article.

To create a GST compliance invoice, you first need to get well versed about what a GST compliance Invoice is. If you are a supplier or service provider that is registered under GST, it is mandatory that you issue a GST compliance invoice when the supply of services or goods is made. Depending on the nature of the supply of goods and services, you will be required to generate an invoice. There are basically three types of invoices.

- Inter-state invoice: This invoice is only required when you supply goods within a state where your business is registered. SGST and CGST are also collected on this same invoice.

- Inter-state Invoice: This invoice is only required when the supply of goods happens between two different states. IGST is collected on the same invoice.

- Export Invoice: This invoice is only required for goods exported outside the country.

A tax invoice is usually issued to charge the tax and to pass on the input tax credit. But the main reason for issuing the invoice is for a clean business and to stay compliant with GST rules. An invoice can be created with the help of different software available online, but you should make sure that fields that are mandatory by the rule of GST are included in the invoice.

Mandatory Feilds required in a GST compliant Invoice

- Details of the supplier. Name, GSTIN of the supplier, and address of the supplier or taxpayer (if registered).

- Name of the state and state code.

- Details of the buyer such as GSTIN, Name, Address, State code, Place, Pin code, Name of the Payee, Account Number, Payment Mode, and IFSC code.

- Invoice Date (Date of issue) and Number.

- Code of Invoice Type.

- Place of Supply.

- Details of Goods or Services like Serial number, description, unit (Kg, Liter, Meter, etc.), quantity, assessable value, amount of SGST/CGST/IGST, total invoice value. Batch name/number.

- Total Taxable value and/or discounts of the Goods and Services.

- The full taxable amount of on supply of services and goods.

- Full value/amount on the supply of services or goods.

- Dispatch Details.

- Invoice item being dispatched.

- Payment of taxes on the Reverse Charge Basis.

- A digital signature of the signatory or agent for the authorized supplier.

- SAC (Services Accounting Codes) and HSN (Harmonized System of Nomenclature) code.

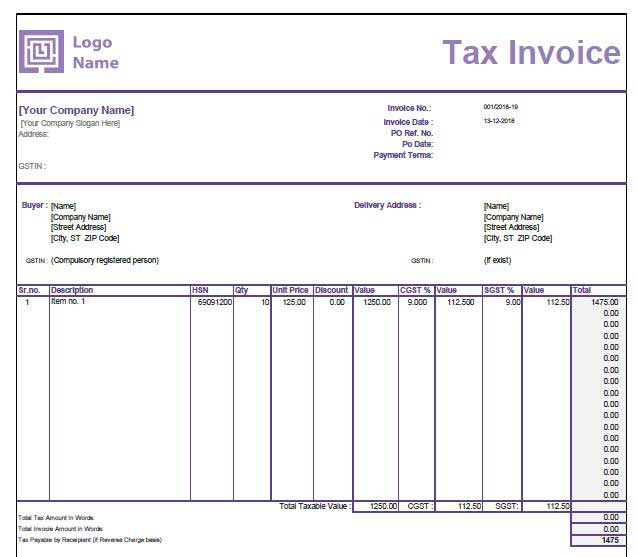

Format of a GST Invoice in Excel

There are GST formats available for free, which you can download. This will help you save time, and you can avoid building a GST invoice from scratch. There are mainly four types of formats that are available online: a Tax format, Tax Breakup, Standard, and IGST Format.

This GST invoice in excel format consists of 5 sections: Header Section, Customer Details Section, Product, and Tax Details Section, Billing Summary Section, and a Signature Section.

- Header Section: This section describes the Business name, address, Business Logo, and GSTIN.

- Customer Details Section: Describes the Name of the Buyer, Buyer’s Address, Invoice Number, Invoice Date, and GSTIN.

- Product and tax details Section: Indicates the product quantity, discounts, units, description, HSE codes, SAC codes, SGST, CGST, and IGST rates.

- Billing Summary Section: Indicates the total billing amount to be paid by the buyer. The taxable amount, SCST, CGST, and IGST amount, total sale amount, and the complete final invoice are automatically calculated.

- The signature Section: This section contains the signatures of the accountant and the receiver, along with some other remarks.

By following the rules mentioned above, you will be able to create an invoice with GST compliance from your PC. The smarter way to create accurate invoices will be to take the assistance of someone who is familiar with creating invoices; that way; it will help you avoid any mistakes and will save time. Even better, it will be best to get good software that will create invoices for you effortlessly. As there have been many changes to the rules and regulations since the introduction of GST, it is expected that there could be some changes in the rules for GST compliance for the invoice too.

Conclusion

There has been a recent announcement made about E-Invoice. If you are a taxpayer or someone who deals with GST invoices, you might be aware that the government has announced that effective from 1st April 2020, E-invoicing is going to be mandatory for certain categories of taxpayers. To be better prepared, you should get familiar with what exactly is E-invoice. E-invoice, as the name suggests, stands for Electronic-Invoice that a taxpayer or businesses has to generate and report to the GST system. The most vital aspect of E-invoice is that it will contain a unique identifier called Invoice Reference Number or (IRN). This IRN will be assigned to individual invoices by the Invoice Registration Portal ( IRP), which is the central registry to which the taxpayers will be reporting their invoices.

This is expected to bring a total change for some sections. GST invoice format in excel might change too, but it is highly unlikely for the immediate future. It will be best to stay updated and visit the GST portal often to know about new changes the GST council makes, and if you are supplying from or to Maharashtra, it will be best to know all about mahagst by frequently visiting mahagst portal.